arizona vs nevada retirement taxes

Local sales taxes increase this total with the largest total rates hitting 105. Retiring in Nevada comes.

2022 Best States To Retire In For Tax Purposes Sofi

How Arizona Property Taxes Work.

. This tool compares the tax brackets for single individuals in each state. Consumers in California are hit with a sales tax of 725. Arizona rose from the ninth spot last year to the third-best state for retirement for 2022.

Florida No income tax low cost of living and warm. The tax burden in Arizona is small compared to that of other states because of its lower. However there are a few places that are more expensive like Kingsbury and Gardnerville.

This adds a significant toll to. You must begin withdrawing funds by age 70 12. If you want to know more about the pros and cons of.

Youll pay no regular or retirement income tax and Nevada property taxes are low. Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. The state sales tax is under 5 although county taxes can drive that number up beyond 8.

As of 2022 eleven states have no tax on regular or retirement income. Arizona rose from the ninth spot last year to the third-best state for retirement for 2022. Florida levies no income tax making it the clear winner over Arizona.

Nevada is also devoid of estate and inheritance taxes and has some of the countrys lowest median property tax rates. Arizona Vs Nevada Where S Better To Retire 20000 for those ages 55 to 64. Alaska Florida Illinois Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas.

Discover whats next Call Us. Property taxes in Nevada are. Growing fast the estimated 2018 Nevada population was 3034392 and New Mexicos population was the smallest at 2095428.

The age statistics suggest that Arizona. States With The Lowest Taxes To Save Retirees Money. Average property tax 607 per 100000 of assessed value 2.

The state offers affordable living and a warm dry climate that draws many retirees. Our blog has the latest news trends and insights about over 2000 active adult retirement communities in the US. However Arizona wins points for having no estate or inheritance.

Arizonas income tax rate runs between 259 and 450 and this unfortunately. The median income is almost the same around 52000 with Nevada in a slight advantage.

13 States That Tax Social Security Benefits Tax Foundation

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Arizona Vs Nevada For Retirement 2021 Aging Greatly

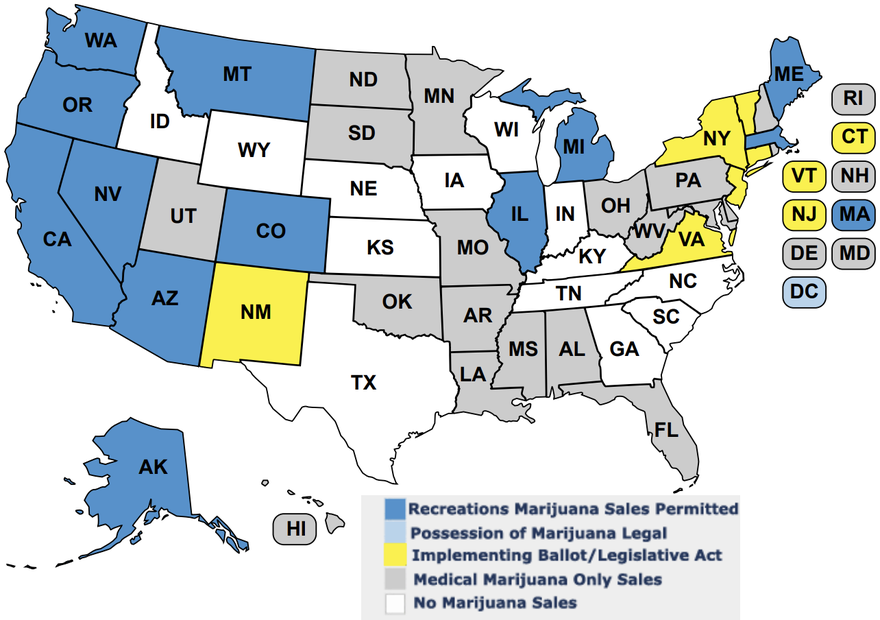

Marijuana Tax Revenue A State By State Breakdown The Motley Fool

The 10 Best Places To Retire In Arizona In 2021 Newhomesource

Military Retirement And State Income Tax Military Com

Is It Better To Retire In Arizona Or Nevada Senior Living Headquarters

The Most Tax Friendly States To Retire

The 10 Best Places To Retire In Nevada In 2021 Newhomesource

Arizona Vs Nevada Which State Is More Retirement Friendly

Study Arizona A So So State For Retiree Taxes

9 Things You Must Know About Retiring To Arizona Kiplinger

States With The Highest Lowest Tax Rates

Arizona Vs Nevada Which State Is More Retirement Friendly

10 Best States For Lowest Taxes Moneygeek Com

2021 State Corporate Tax Rates And Brackets Tax Foundation

The 5 Best States To Retire To That Aren T Florida Or Arizona